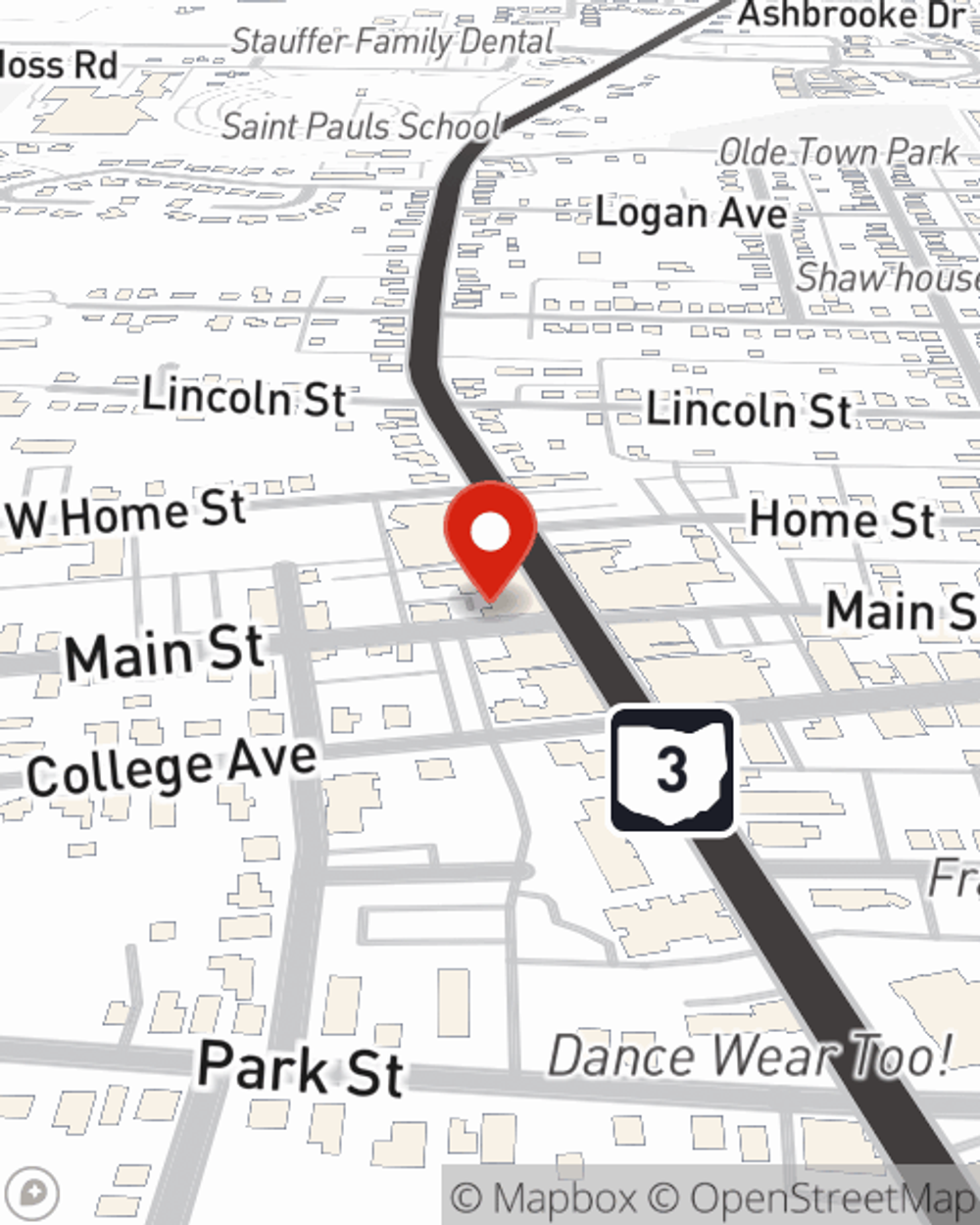

Renters Insurance in and around Westerville

Welcome, home & apartment renters of Westerville!

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

Trying to sift through coverage options and savings options on top of managing your side business, keeping up with friends and work, can be overwhelming. But your belongings in your rented space may need the terrific coverage that State Farm provides. So when trouble knocks on your door, your linens, furniture and home gadgets have protection.

Welcome, home & apartment renters of Westerville!

Renters insurance can help protect your belongings

There's No Place Like Home

You may be unconvinced that Renters insurance is really necessary, but what many renters don't know is that your landlord's insurance generally only covers the structure of the house. What would happen if you had to replace your personal property can be substantial. With State Farm's Renters insurance, you have a good neighbor who can help when windstorms or tornadoes occur.

If you're looking for a dependable provider that can help with all your renters insurance needs, visit State Farm agent Justin Giger today.

Have More Questions About Renters Insurance?

Call Justin at (614) 882-9414 or visit our FAQ page.

Simple Insights®

The ins and outs of moving insurance

The ins and outs of moving insurance

Moving insurance can help you stay covered and protect your move. Before you purchase moving insurance, read these basics.

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

Justin Giger

State Farm® Insurance AgentSimple Insights®

The ins and outs of moving insurance

The ins and outs of moving insurance

Moving insurance can help you stay covered and protect your move. Before you purchase moving insurance, read these basics.

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.